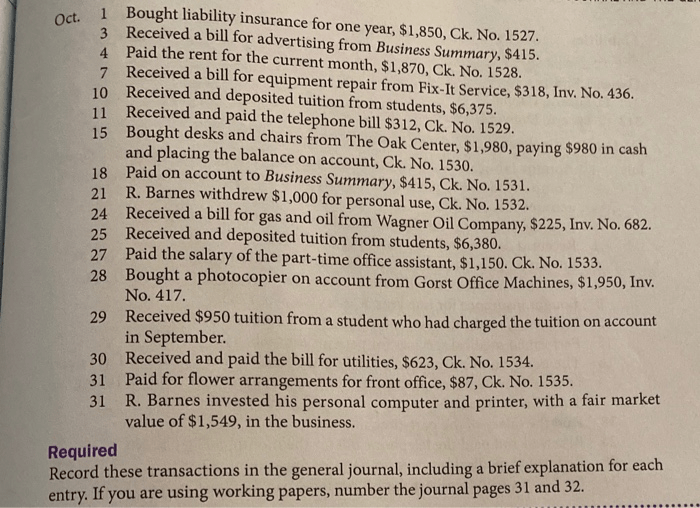

Payments for advertising equipment repairs utilities and rent are liabilities – Understanding the nature and accounting treatment of payments for advertising, equipment repairs, utilities, and rent is crucial for businesses to accurately report their financial position and performance. These payments often represent significant liabilities, and their proper classification and recording impact the balance sheet, financial ratios, and key performance indicators.

This comprehensive analysis delves into the specific characteristics of each type of payment, providing guidance on how to determine whether they qualify as liabilities and how to account for them accordingly.

Payments for Advertising

Payments for advertising are expenses incurred by businesses to promote their products or services to potential customers. These expenses can include costs for creating and placing advertisements in various media channels, such as television, print, radio, and online platforms.

Examples of advertising expenses include:

- Television and radio commercials

- Print ads in newspapers and magazines

- Online advertising on websites and social media

- Billboard rentals

- Public relations campaigns

In accounting, advertising expenses are typically recorded as an expense in the period in which they are incurred. This is because advertising benefits the business in the current period rather than in future periods.

Payments for Equipment Repairs

Payments for equipment repairs are expenses incurred by businesses to maintain and repair equipment used in their operations. These expenses can include costs for parts, labor, and other materials needed to restore equipment to working condition.

To determine if an equipment repair is a liability, consider the following factors:

- The nature of the repair: Is it a major repair that significantly extends the life of the equipment, or a minor repair that simply restores it to its original condition?

- The cost of the repair: Is it material in relation to the value of the equipment?

- The likelihood of the repair being successful: Is it probable that the repair will restore the equipment to working condition?

If the answer to these questions is yes, then the equipment repair should be recorded as a liability on the balance sheet. Otherwise, it should be recorded as an expense in the period in which it is incurred.

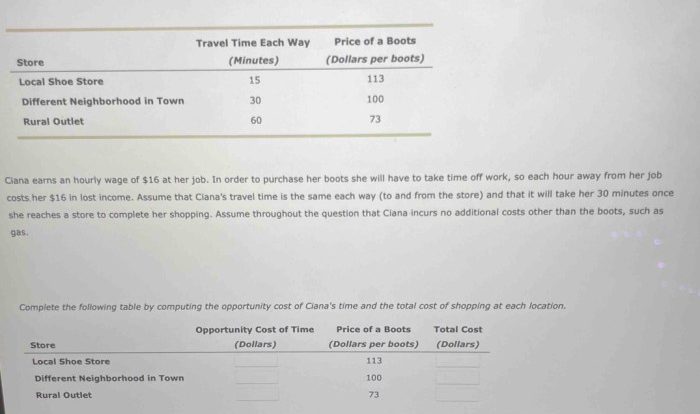

Payments for Utilities: Payments For Advertising Equipment Repairs Utilities And Rent Are Liabilities

Payments for utilities are expenses incurred by businesses for the use of essential services such as electricity, gas, water, and telecommunications. These expenses are typically recorded as an expense in the period in which they are incurred.

The different types of utilities that can be considered liabilities include:

- Unpaid utility bills

- Utility deposits

- Estimated utility expenses

Unpaid utility bills are a liability because the business owes money to the utility company. Utility deposits are also a liability because they represent a prepayment for future utility services. Estimated utility expenses are a liability because they represent an obligation to pay for utility services that have been consumed but not yet billed.

Payments for Rent

Payments for rent are expenses incurred by businesses for the use of property owned by another party. These expenses can include costs for rent, utilities, property taxes, and insurance.

In accounting, rent payments are typically recorded as an expense in the period in which they are incurred. This is because rent benefits the business in the current period rather than in future periods.

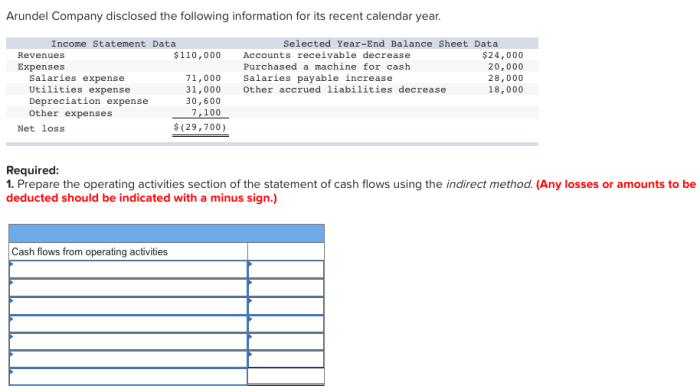

Overall Impact on Financial Statements

Payments for advertising, equipment repairs, utilities, and rent can have a significant impact on a business’s financial statements. These expenses can affect the balance sheet, income statement, and cash flow statement.

On the balance sheet, advertising expenses are recorded as an asset if they are expected to generate future benefits. Equipment repair liabilities are recorded as a liability. Unpaid utility bills, utility deposits, and estimated utility expenses are also recorded as liabilities.

Rent payments are not recorded on the balance sheet.

On the income statement, advertising expenses are recorded as an expense in the period in which they are incurred. Equipment repair liabilities are recorded as an expense when the liability is incurred. Unpaid utility bills, utility deposits, and estimated utility expenses are recorded as an expense when the utility services are consumed.

On the cash flow statement, advertising expenses are recorded as an operating expense. Equipment repair liabilities are recorded as an operating expense or a capital expenditure, depending on the nature of the repair. Unpaid utility bills, utility deposits, and estimated utility expenses are recorded as an operating expense.

Question & Answer Hub

What are the common examples of advertising expenses?

Examples of advertising expenses include print advertising, television and radio commercials, online advertising, and social media campaigns.

How do I determine if an equipment repair is a liability?

An equipment repair is considered a liability if it results in a future economic obligation, such as a warranty or a service contract.

What are the implications of unpaid utility bills?

Unpaid utility bills can lead to late payment penalties, service disconnections, and damage to a business’s credit rating.